Last Updated:

Most downloads surged because TikTok vanished, not because Indian alternatives were stronger. Users joined out of necessity, not loyalty, left as soon as better options returned

Arattai entered the scene when digital self-reliance was a national conversation, privacy concerns are rising, and several Indian apps had already fallen.

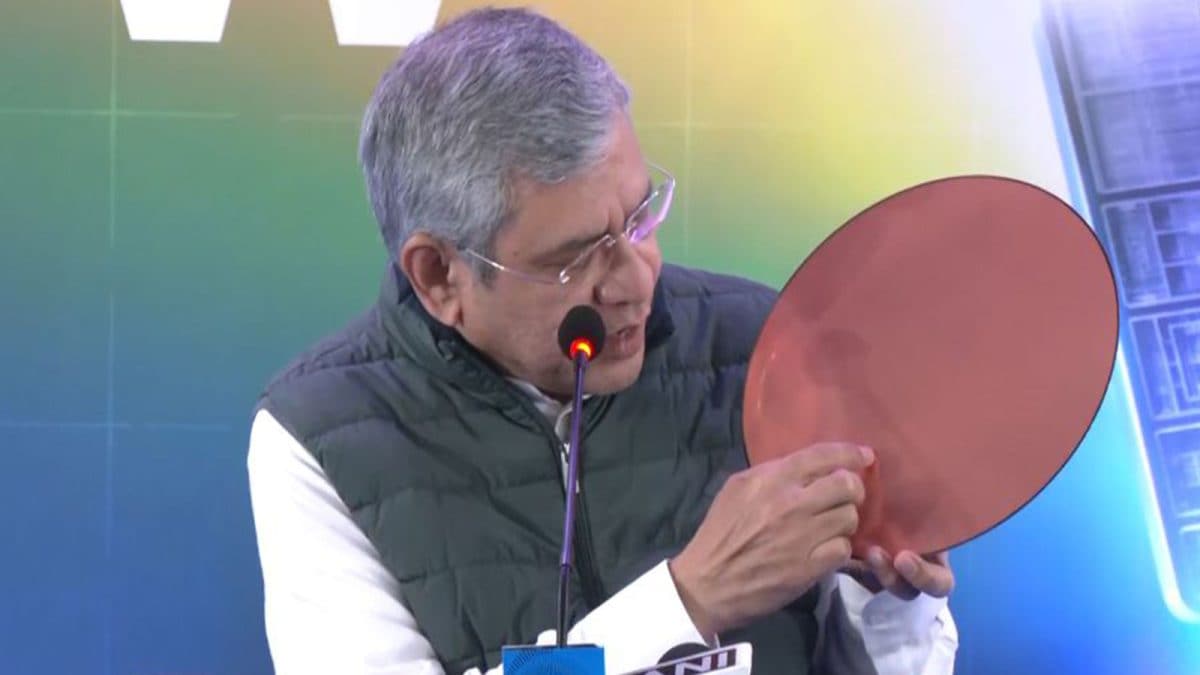

Made-in-India messaging app Arattai has entered the market promising stronger privacy, a cleaner design, and a genuinely homegrown alternative to WhatsApp and Telegram. But its arrival has reopened an uncomfortable question: Why do Indian apps rise with enormous hype and then collapse quietly, while American and Chinese technology platforms remain unshakeably dominant?

Over the past few years, India has watched several ambitious apps surge and then disappear—ShareChat shrinking operations, Moj losing momentum, Chingari struggling to stay alive, and Koo shutting down altogether. Meanwhile, Meta’s suite of platforms, YouTube, Google services, TikTok clones, and the Apple-Google app ecosystem continue to shape everyday digital behaviour in India.

This story is bigger than the competition. It is about structural disadvantages, the power imbalance between Indian start-ups and foreign tech giants, and the complete dependency of Indian apps on global platforms.

The Rise, And Rapid Decline Of India’s App Boom

TikTok’s sudden ban in 2020 created what many believed was a once-in-a-generation opportunity. For the first time, India had a clear runway to build its own short-video and social media ecosystem without competing with China’s most powerful algorithm.

Indian alternatives burst into the space almost overnight. Moj, Josh, Chingari, Roposo, Trell, and several others were downloaded at staggering speed. Creators rushed in. Investors celebrated the possibility of a ‘Made-in-India’ digital universe.

But within three years, the dream had cracked. Moj began cutting teams, ShareChat laid off thousands, Chingari edged towards shutdown, Trell collapsed financially, and Koo—once a political and cultural talking point—had to close after failing to secure buyers.

What Went Wrong?

The biggest issue was that most downloads were triggered by TikTok’s absence, not the strength of Indian alternatives. Users came in because they had no other option, not because these apps offered a superior product. As soon as Instagram improved Reels and YouTube strengthened Shorts, users abandoned Indian platforms almost instantly.

Then there was the technology gap. Apps like TikTok and Instagram rely on recommendation engines built through years of AI research and billions of dollars in R&D — an advantage Indian start-ups could not replicate. Without powerful algorithms to personalise content, their feeds felt repetitive and less engaging.

Monetisation was equally difficult. Creators expect consistent income, and brands expect measurable results. Indian platforms struggled to deliver either. Meanwhile, the cost of running a social media app is enormous—servers, moderation, engineering talent, creator payouts. Revenue could not catch up, and investor enthusiasm faded once early growth slowed. India had the users, but Indian apps simply did not have the financial runway to keep up.

Koo: India’s Most Symbolic Failure

Nothing captured India’s digital ambitions as dramatically as Koo. Launched as a multilingual alternative to Twitter, it gained quick political traction and large bursts of traffic during national debates.

But sustaining momentum proved impossible. User growth slowed, infrastructure costs grew too heavy, global advertising networks never arrived, and Koo lacked the deep-pocketed strategic partners that Silicon Valley apps take for granted. Its dependence on political cycles created volatility — traffic spiked during controversies but dropped just as fast afterwards. Ultimately, the platform shut down, leaving behind a harsh lesson: competing with global social networks requires far more than patriotic sentiment and early downloads.

ShareChat, Moj, And The Limits Of India’s Digital Spending

ShareChat was India’s biggest vernacular success story. It understood tier-2 and tier-3 India better than any global app. Yet even this giant could not escape structural economic limits.

Regional advertising generates far less revenue than English-language ecosystems. Moderation and server costs were overwhelming. Moj, built as a TikTok-style product, could not match the algorithmic sophistication of international platforms. As user retention declined and funding slowed, layoffs became inevitable.

ShareChat’s struggles highlight a deeper truth: India is a huge user market, but not yet a high-spending digital economy. People scroll endlessly, but they don’t spend as much, creating a major mismatch between scale and revenue.

India’s App Economy Runs On US Infrastructure

There is another uncomfortable reality—Indian apps are entirely dependent on Google’s Play Store and Apple’s App Store. These two companies control everything from downloads and discoverability to payments and policy rules.

Their 15-30% commission on in-app purchases is punishing for start-ups already struggling with revenue. Their recommendation algorithms decide which apps rise and which remain buried. And while India has UPI, many apps still depend on Google’s billing system for in-app transactions.

A single policy change or ranking shift by Google can erase lakhs of potential downloads overnight. India may have hundreds of millions of users, but the gateways to reach them are not in India’s control.

Why India Has Not Been Able to Build a ‘Bharat App Store’

Despite repeated discussions and prototypes, no Indian alternative to the Play Store or App Store has managed to scale. The challenge is far more complex than launching a marketplace.

A successful app store requires secure hardware-software integration, trusted payment systems, strong malware protection, developer incentives, global-standard rating systems, and massive engineering investment. Users also hesitate to download third-party app stores due to security fears, while developers are reluctant to upload apps where traffic is uncertain.

Combined with India’s relatively low ad revenue and minimal in-app spending, a domestic app store has never reached mainstream adoption.

Data Sovereignty: The Silent Risk

Every time an Indian app shuts down, a new problem emerges—data. If a foreign platform closes, user data remains stored abroad under clear policies. If an Indian start-up collapses unexpectedly, user data often becomes inaccessible, unprotected, or simply disappears.

This raises serious questions about data ownership, jurisdiction, and user rights. India’s dependency on global digital infrastructure is not just economic—it is geopolitical.

Why Foreign Tech Giants Continue to Win

Global tech giants operate with overwhelming advantages. They have cutting-edge AI, multi-billion-dollar R&D budgets, world-leading ad networks, strong creator monetisation systems, seamless international user bases, and infrastructure that Indian start-ups cannot match. Competing with them is like bringing a knife to a gunfight.

Indian apps innovate with limited resources. Global platforms innovate with global empires behind them. The imbalance speaks for itself.

Can Arattai Break The Pattern?

Arattai entered the scene when digital self-reliance was a national conversation, privacy concerns are rising, and several Indian apps had already fallen. The timing is favourable. User sentiment is supportive. But the same hurdles remain — app-store dependency, high customer acquisition costs, limited monetisation options, and the enormous challenge of competing with WhatsApp’s entrenched network effects.

Patriotism might bring downloads. It will not guarantee survival. For Arattai to succeed, it must deliver world-class engineering, long-term capital, and a sustainable business model.

A Digital Supermarket, Not Yet A Digital Builder

India has the world’s largest YouTube audience, the largest WhatsApp user base, one of the biggest Instagram communities, and an exploding short-video market. But almost none of the top 20 apps used in India are Indian.

India generates attention and data; foreign companies capture the value.

Unless India builds its own digital infrastructure — its own app distribution systems, a strong ad-tech ecosystem, long-term funding pipelines, and competitive AI capabilities — Indian apps will continue rising quickly but collapsing just as fast.

The next Indian tech breakthrough will require more than timing. It will require an entire ecosystem shift.

Shilpy Bisht, Deputy News Editor at News18, writes and edits national, world and business stories. She started off as a print journalist, and then transitioned to online, in her 12 years of experience. Her prev…Read More

Shilpy Bisht, Deputy News Editor at News18, writes and edits national, world and business stories. She started off as a print journalist, and then transitioned to online, in her 12 years of experience. Her prev… Read More

November 06, 2025, 17:47 IST

Stay Ahead, Read Faster

Scan the QR code to download the News18 app and enjoy a seamless news experience anytime, anywhere.