The strong Q3 performance was powered by double-digit increases across all key regions and categories. Footwear revenues rose 11 per cent, led by significant gains in Running, Football, Training, and Specialist Sports.

Germany’s Adidas has reported record revenue of €6.63 billion (~$7.69 billion) in Q3 2025, the highest in its history, as brand sales rose 12 per cent on a currency-neutral basis.

Growth was broad-based across all regions and categories, with footwear and apparel driving strong gains.

Despite currency and tariff headwinds, profitability improved, with operating profit rising 23 per cent.

Apparel sales surged 16 per cent, fuelled by momentum in Originals, Football, and Running, supported by differentiated and locally relevant collections. Accessories posted a 1 per cent increase.

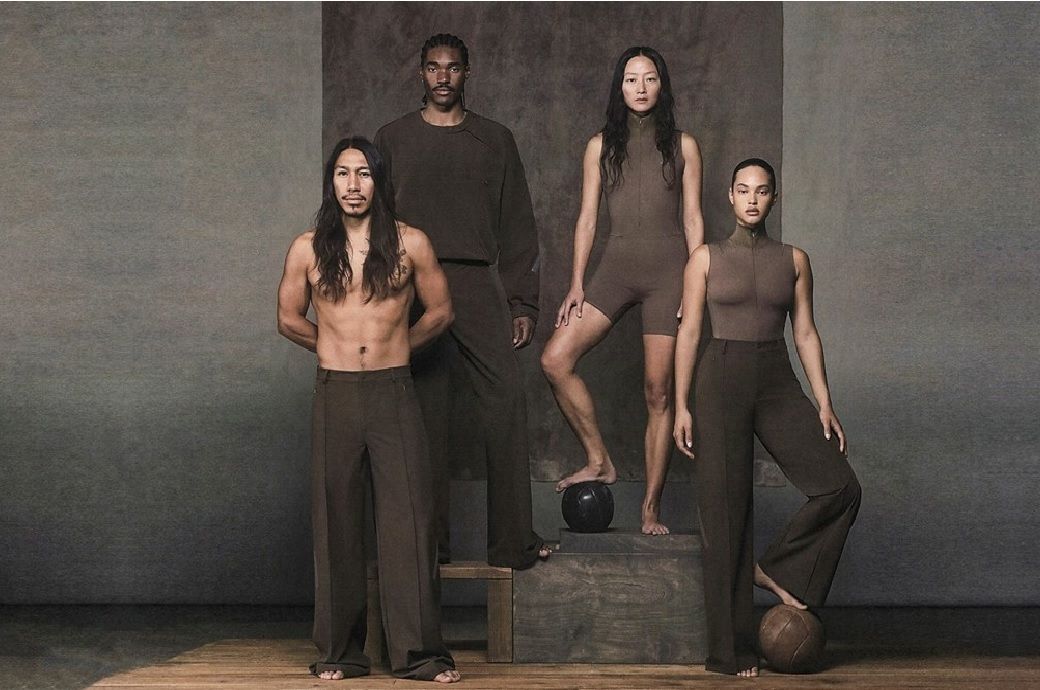

Performance categories grew 17 per cent, led by strong traction in Running and Football. The brand’s lifestyle business also expanded by 10 per cent, driven by enduring demand for its Terrace franchises, collaborations with Wales Bonner, Oasis, Edison Chen, and market-specific activations, Adidas said in a press release.

Region-wise, revenues for the Adidas brand grew 12 per cent in Europe, 10 per cent in Greater China, 13 per cent in Emerging Markets, 21 per cent in Latin America, 11 per cent in Japan/South Korea, and 8 per cent in North America. Growth was consistent across all channels, with wholesale sales up 10 per cent, own retail up 13 per cent, and e-commerce surging 15 per cent—building on more than 25 per cent growth in the same quarter last year.

Adidas improved its gross margin by 0.5 percentage points to 51.8 per cent, supported by lower product and freight costs, a favourable business mix, and strong sell-throughs that offset the impact of adverse currency movements and higher US tariffs. Operating profit climbed 23 per cent to €736 million, delivering an operating margin of 11.1 per cent compared to 9.3 per cent a year ago.

Net income from continuing operations rose 3 per cent to €482 million, despite hyperinflation-related effects that weighed on the financial result. Marketing and point-of-sale expenses increased 10 per cent to €798 million, reflecting continued investments in global campaigns and new partnerships such as Liverpool FC and the future Audi Formula 1 team.

“I am extremely proud of what our teams achieved in the third quarter with actually record revenues. Twelve per cent growth for the adidas brand leading to total revenue of €6.63 billion is the highest we have ever achieved as a company in a quarter. I am especially happy to see that our performance business is growing strongly across categories and in all regions,” said Bjorn Gulden CEO at Adidas. “2025 is already a success for us. Fourteen per cent growth for the Adidas brand year-to-date and an EBIT margin above 10 per cent proves how strong our brand is. Empowering our local markets to win their consumers is the right strategy for global success.”

In the first nine months (9M) of 2025, Adidas brand revenues grew 14 per cent on a currency-neutral basis, or more than €2.2 billion in absolute terms, despite the absence of Yeezy revenues which had contributed over €550 million in 2024. In euro terms, sales reached €18.74 billion, up 6 per cent year-over-year (YoY).

Footwear and apparel sales each rose 14 per cent in 9M, driven by strong gains in Originals, Sportswear, Running, and Training. Double-digit growth was recorded across all regions—Europe (+11 per cent), North America (+12 per cent), Greater China (+12 per cent), Latin America (+24 per cent), Emerging Markets (+17 per cent), and Japan/South Korea (+14 per cent).

The gross margin improved 0.8 percentage points to 51.9 per cent, while operating profit surged 48 per cent to €1.89 billion, representing an operating margin of 10.1 per cent. Net income climbed 52 per cent to €1.29 billion, highlighting the brand’s strong recovery and efficiency gains across its operations.

Inventories increased 21 per cent YoY to €5.47 billion, reflecting support for planned top-line growth, earlier product purchases for World Cup-related launches, and faster inbound deliveries. Operating working capital rose to €6.18 billion, or 21.9 per cent of sales. Cash and cash equivalents stood at €1.03 billion, while adjusted net borrowings increased to €4.79 billion, leading to a leverage ratio of 1.6x, an improvement from 2.1x last year, added the release.

Moreover, Adidas has raised its full-year 2025 guidance. The company now expects overall revenues to grow by around 9 per cent (previously projected at a high-single-digit rate) and operating profit to reach approximately €2 billion, up from the prior range of €1.7–1.8 billion.

“The focus is now on transitioning well into 2026, which will be another exciting sports year with the Winter Olympics and the biggest Football World Cup ever. Adidas connects sport and street culture, and we see global demand for all these segments continuing to grow. That is why we look positive into the future,” added Gulden.

Fibre2Fashion News Desk (SG)