Last Updated:

AAUM of domestic mutual funds rose 14.37 percent YoY in Sep 2025, led by Growth oriented equity schemes.

Mutual Fund Assets Surge 14% in a Year, Driven by Equity Boom and Maharashtra’s Dominance

The Average Assets Under Management (AAUM) of the domestic mutual fund industry grew by 14.37% on a yearly basis for the period ended Sep 2025. On a monthly basis, the same rose by 1.39%.

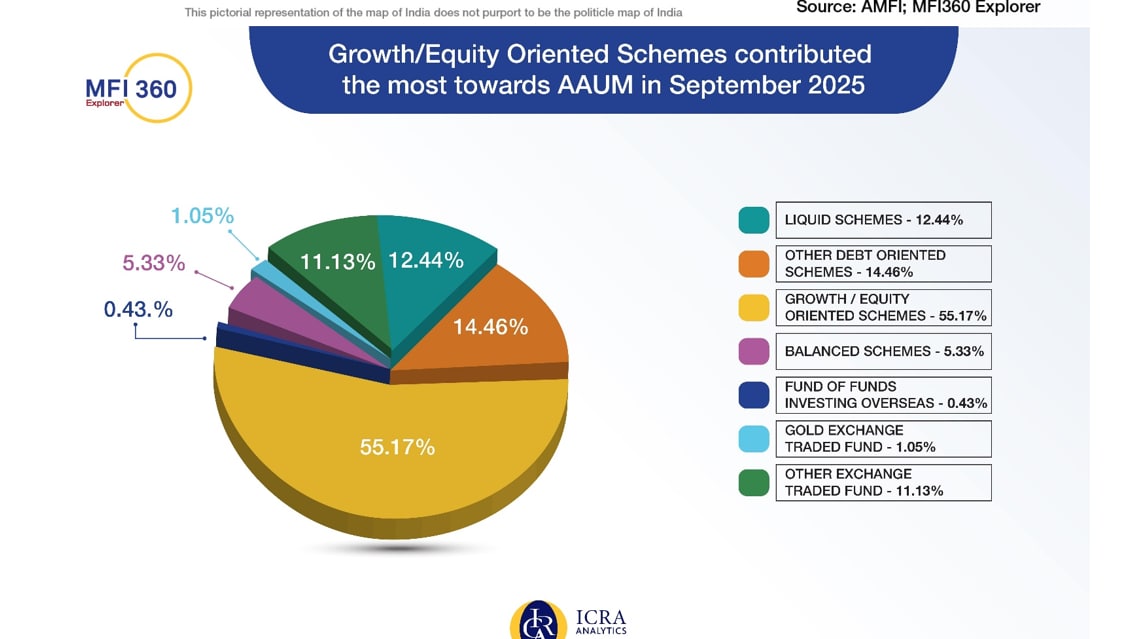

Contribution of Growth oriented equity-oriented schemes remained the maximum at 55.17% followed by debt-oriented schemes and liquid schemes which contributed 14.46% and 12.44% respectively. Growth/Equity Oriented Schemes contributed the most to the AAUM across the states. The contribution of equity-oriented schemes was the most in Ladakh which stood at 90.61% followed by Lakshadweep for which contribution of equity-oriented schemes stood at 83.43%.

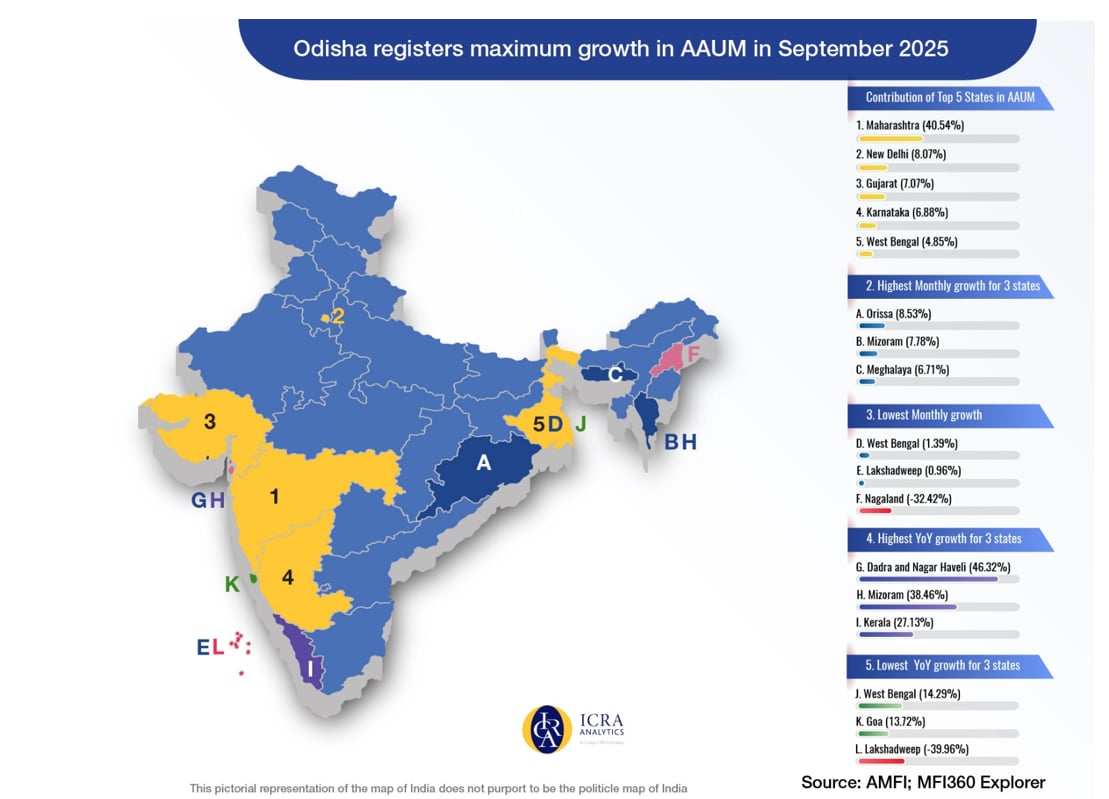

Amongst the states, Maharashtra lead with a maximum contribution of 40.54% followed by New Delhi, Gujarat, Karnataka and West Bengal whose respective contributions remained below 10%. The top five states contributed 67.41% to the domestic mutual fund industry AAUM.

On a monthly basis, Odisha witnessed the maximum growth in AAUM which stood at 8.53% followed by Mizoram and Meghalaya which grew 7.78% and 6.71%, respectively.

On a yearly basis, Dadra and Nagar Haveli witnessed the maximum growth in AAUM which stood at 46.32% followed by Mizoram which grew 38.46%. Barring Lakshwadeep, all states witnessed growth in AAUM on a yearly basis in Sep 2025, the minimum being that of Goa whose AAUM grew 13.72% YoY in Sep 2025. The AAUM contribution from Lakshwadeep fell 39.96% on YoY basis in Sep 2025.

Varun Yadav is a Sub Editor at News18 Business Digital. He writes articles on markets, personal finance, technology, and more. He completed his post-graduation diploma in English Journalism from the Indian Inst…Read More

Varun Yadav is a Sub Editor at News18 Business Digital. He writes articles on markets, personal finance, technology, and more. He completed his post-graduation diploma in English Journalism from the Indian Inst… Read More

October 27, 2025, 15:10 IST

Read More