Last Updated:

India is now Asia’s fourth-largest market for InvITs and REITs, with AUM rising to USD 93.9 billion in FY 2025, says Knight Frank India, projecting USD 257.9 billion by 2030.

Investments in India’s infrastructure have expanded rapidly in recent years, driven by the need to modernise assets and boost efficiency, the report said.

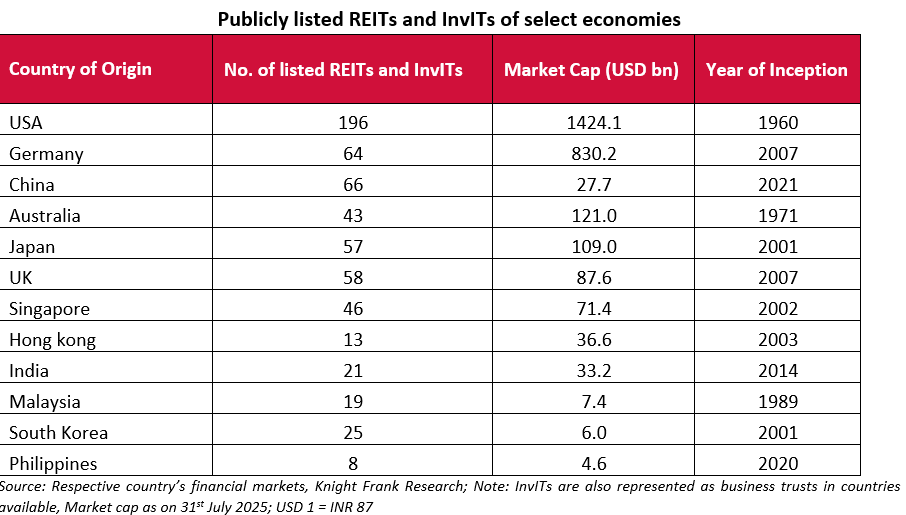

India has become the fourth-largest market for Infrastructure Investment Trusts (InvITs) and Real Estate Investment Trusts (REITs) in Asia region, with combined AUM growing to USD 93.9 billion in FY 2025 from 42.1 billion in FY 2024, according to a new study by Knight Frank India.

In India, there are currently five REITs and seventeen InvITs listed in the stock exchange, with a combined market capitalization of USD 33.2 bn, the report underlined.

InvITs have attracted investors to invest in India’s infrastructure growth story. The total Assets Under Management (AUM) of InvITs in India has reached approximately USD 73 billion in FY 2025, reflecting a major chunk in infrastructure investment destinations in the country.

The Knight Frank India report projected that the AUM of InvITs could grow to 3.5 times to USD 257.9 billion by 2030. This growth will be propelled by higher allocations from institutional investors, increased participation of domestic pension and insurance funds, expanded foreign investment, and rising awareness among retail investors.

Infrastructure Investment Trusts (InvITs) and Real Estate Investment Trusts (REITs) are investment vehicles that pool money from investors to own and operate income-generating infrastructure and real estate assets. While REITs primarily focus on commercial real estate such as office spaces, malls, and data centres, InvITs channel funds into operational infrastructure assets like roads, power transmission lines, renewable energy projects, and logistics.

Investment Potential of InvITs In India’s Infra Growth Story

Investments in India’s infrastructure have expanded rapidly in recent years, driven by the need to modernise assets and boost efficiency, the report said.

It further said Central government spending on core infrastructure surged from USD 12 bn in FY 2015 to USD 75 bn in FY 2025, a 6.2-fold rise, growing from 0.6% of GDP to 2.0% over the same period, reflecting a strong policy focus on infrastructure-led growth.

On the backdrop of this accelerating growth, the report said, InvITs have emerged as an effective financing tool, directing institutional and retail funds into operational assets, enabling capital recycling, and supporting timely infrastructure development.

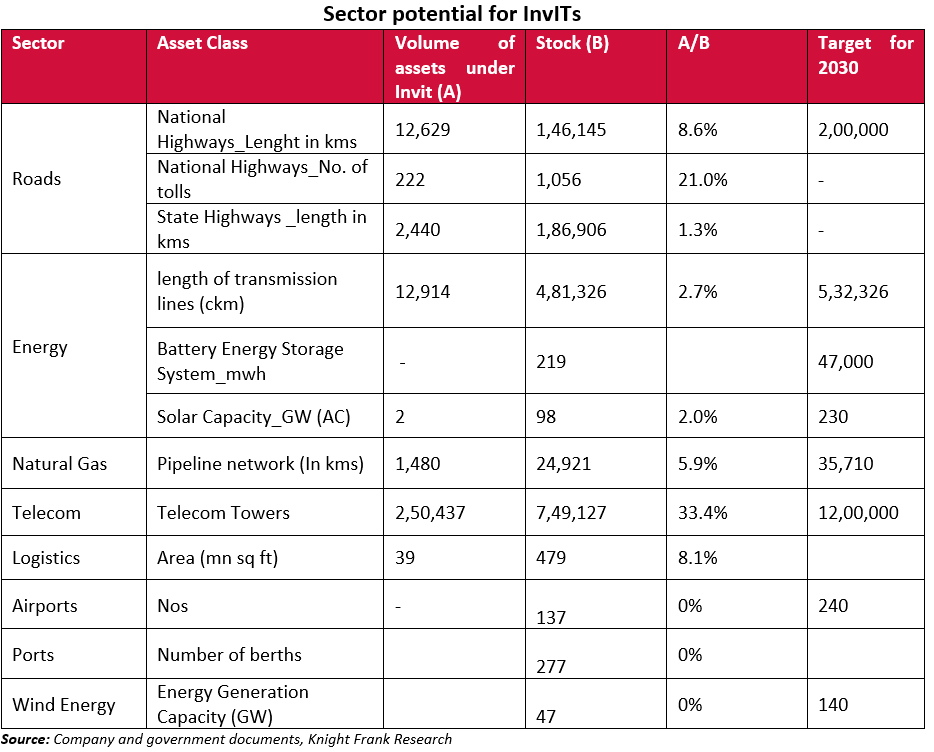

“The potential for InvIT expansion in India remains significant across multiple infrastructure sectors. In roads, InvITs are the largest segment by value, comprise only 21% of operating NHAI toll assets, leaving ample scope for monetisation. In renewable energy, despite installed solar capacity exceeding 98 GW, InvITs manage just ~2% of operational assets, with the government targeting 230 GW by 2030. In logistics, only ~39 mn sq ft of the 479 mn sq ft controlled by private operators is within InvIT structures,” the report pointed out.

It also said that opportunities go beyond existing assets, with capacity expansions planned in roads, renewable energy, ports, airports, power transmission, and logistics driven by economic growth, urbanization, and industrialisation.

Overall, the InvIT market in India could reach approximately USD 258 bn by 2030, scaling existing sectors and bringing underrepresented asset classes into the fold.

The report identifies several strategies to unlock the next phase of InvIT growth:

• Expanding Retail Participation: Increasing awareness and accessibility of InvITs through targeted investor education campaigns, simplified investment processes, and inclusion in mainstream wealth management offerings.

• Hedging Currency Risk for Foreign Investors: Offering cost-effective currency hedging tools to mitigate forex volatility and encourage higher foreign capital inflows.

• Broadening Domestic Institutional Exposure: Raising exposure limits for pension and insurance funds and encouraging public sector financial institutions to participate more actively.

• Diversification of Sectors: Bringing new asset categories such as data centres, urban transport, and water infrastructure into the InvIT framework to broaden the investment base.

In conclusion, the report said, by deepening domestic institutional participation, expanding retail access, and attracting greater foreign investment through risk-hedging measures, India can secure a stable and diversified capital base for its infrastructure pipeline. In doing so, the country not only strengthens its position as Asia’s fourth largest REIT and InvIT market but also moves closer to becoming a global leader in infrastructure investment.

Varun Yadav is a Sub Editor at News18 Business Digital. He writes articles on markets, personal finance, technology, and more. He completed his post-graduation diploma in English Journalism from the Indian Inst…Read More

Varun Yadav is a Sub Editor at News18 Business Digital. He writes articles on markets, personal finance, technology, and more. He completed his post-graduation diploma in English Journalism from the Indian Inst… Read More

Read More