Last Updated:

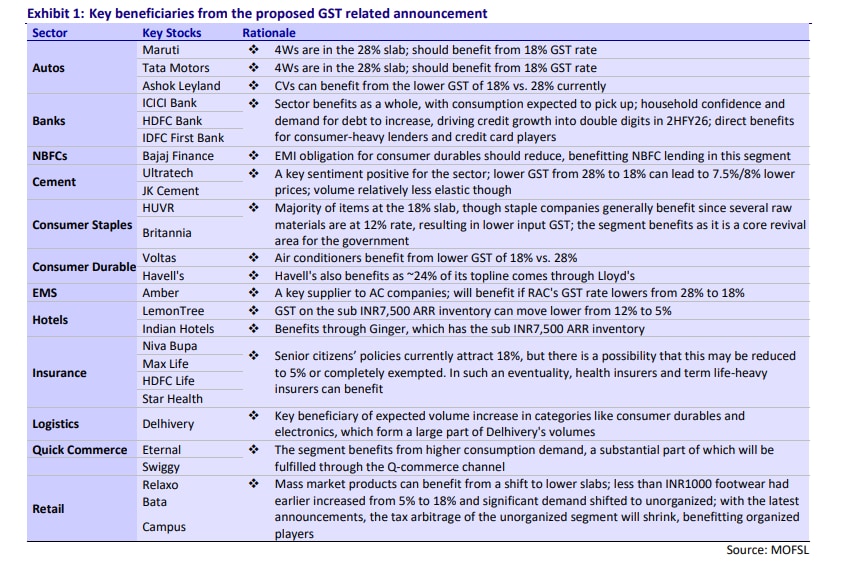

Brokerage firm Motilal Oswal Financial Services (MOFSL) in its latest report gives a list of 26 stocks that are likely to benefit from the proposed GST ‘big bang’ reforms.

With consumption expected to pick up, banks such as ICICI Bank, HDFC Bank and IDFC First Bank are set to benefit from stronger credit demand, particularly in consumer loans and credit cards, says MOFSL.

Indian equity markets are set for a strong start to the week as sentiment turns upbeat following Prime Minister Narendra Modi’s Independence Day announcement of a major overhaul in the Goods and Services Tax (GST) structure. The proposed changes, widely referred to as GST 2.0, aim to simplify the tax regime and boost consumption, with analysts flagging multiple sectors that stand to gain.

According to reports, the Centre is considering scrapping the current 12% and 28% GST slabs, realigning most items into the 5% and 18% categories. Certain sin or luxury goods may be placed in a new 40% bracket. The rejig is expected to help stimulate demand and support India’s growth momentum.

Brokerage firm Motilal Oswal Financial Services (MOFSL) in its latest report on August 18 gives a list of 26 stocks that are likely to benefit from the proposed GST ‘big bang’ reforms. It said the move could unlock opportunities across autos, cement, consumer staples, durables, retail, and financials, while also easing compliance for businesses.

Autos to Drive Ahead

Motilal Oswal said passenger vehicle makers Maruti Suzuki and Tata Motors, currently paying 28% GST, are expected to benefit significantly if rates are lowered to 18%. Commercial vehicle maker Ashok Leyland may also see demand tailwinds as GST on trucks and buses comes down to 18% from the current 28%.

Banks and NBFCs in Focus

With consumption expected to pick up, banks such as ICICI Bank, HDFC Bank and IDFC First Bank are set to benefit from stronger credit demand, particularly in consumer loans and credit cards. Among NBFCs, Bajaj Finance could see reduced EMI obligations on consumer durables, improving affordability and driving loan growth, according to MOFSL.

Cement and Building Materials to Gain

Lowering GST on cement from 28% to 18% could cut prices by up to 7.5-8%, Motilal Oswal estimates. This would be a key sentiment booster for the sector, especially for majors like UltraTech Cement, JK Cement, and HeidelbergCement (HUWR), given cement’s relatively inelastic demand profile, MOFSL said.

Consumer Staples and Durables

In FMCG, most products currently taxed at 18% may remain unchanged, but companies such as Britannia could benefit as input costs reduce — since many raw materials attract 12% GST today.

Consumer durable companies stand to gain more directly. Voltas could benefit from a lower GST on air-conditioners, while Havells would gain as about 24% of its sales come from Lloyd ACs, which may see a cut from 28% to 18%, according to MOFSL.

Electronics Manufacturing & Hotels

Electronics maker Amber Enterprises, a key supplier to AC brands, is expected to benefit from lower GST on RACs. In hospitality, Lemon Tree Hotels and Indian Hotels may see improved profitability as GST on sub-Rs 7,500 room tariffs is proposed to be cut from 12% to 5%, the brokerage firm said.

Insurance and Financial Services

The GST rejig could also support insurers. Currently, premiums on life and health policies attract 18% GST. Analysts believe this may be reduced to 5% or exempted altogether, boosting affordability and demand. Niva Bupa, Max Life, HDFC Life and Star Health could be key beneficiaries, it added.

Logistics, Retail and Quick Commerce

Delhivery may gain from higher volumes of consumer durables and electronics if demand revives. In quick commerce, Eternal and Swiggy stand to benefit from increased discretionary spending, MOFSL said.

Retailers like Relaxo, Bata and Campus may also be winners as mass footwear (below Rs 1,000) — earlier taxed at 18% from 5% — could shift back into a lower bracket, narrowing the tax arbitrage between organised and unorganised players.

Market Outlook Today

The GST overhaul has been welcomed by markets, with analysts expecting a consumption-driven rally across auto, cement, FMCG, and financial names. Early trends in GIFT Nifty suggest a gap-up opening, with the index trading 266 points or 1.07% higher at 24,921 in pre-market hours.

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h…Read More

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h… Read More

view comments

Read More