Even in the digital era, cheques continue to be widely used for transferring large sums of money. However, many people remain unclear about the purpose of signing the back of a cheque and the rules associated with it. While some sign out of habit when handing a cheque to a bank or another person, the practice serves a specific regulatory and security purpose. (News18 Telugu)

One of the most common types of cheques, bearer cheques, carry certain risks. Money can be claimed not only by the person named on the cheque but also by the holder of the cheque. To prevent misuse, banks require a signature on the back for identification and record-keeping. The person presenting the cheque at the bank is expected to sign. (News18 Telugu)

Account Payee Cheques are considered more secure. They are marked with two parallel lines and the phrase ‘Account Payee Only’, ensuring that funds are deposited directly into the intended account. For such cheques, signing on the back is not required. (News18 Telugu)

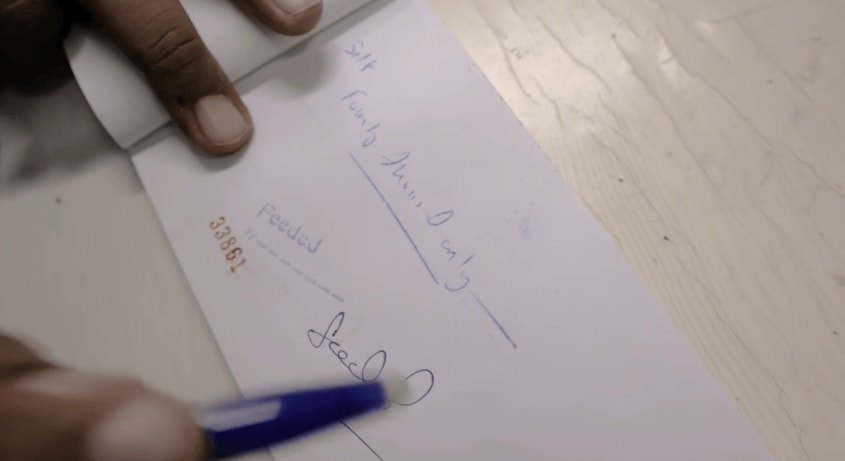

According to RBI regulations, a signature is necessary only on the back of bearer cheques. If a bearer cheque is deposited in someone else’s name, the bank collects the depositor’s signature for verification. In some cases, banks may also request a signature when the cheque is deposited in the account of the named individual, purely for record-keeping purposes. (News18 Telugu)

Signing provides the bank with assurance that the cheque has been received by the rightful recipient and creates an official record of the transaction. This record can serve as evidence in case of any dispute and also helps prevent misuse if the cheque is lost or stolen. (News18 Telugu)

Each signature should be executed carefully. An incorrect signature can put funds at risk. Understanding the purpose of signing the back of a cheque ensures that the process contributes effectively to security and accountability. (News18 Telugu)