Last Updated:

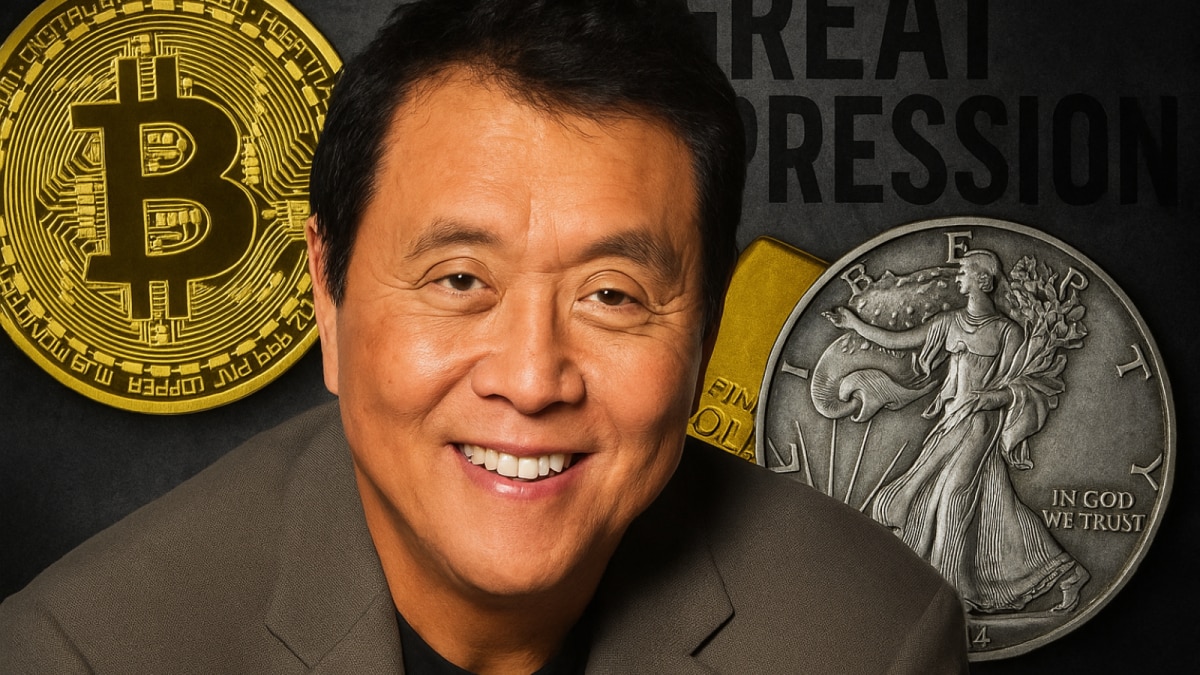

Robert Kiyosaki has frequently predicted a sharp correction in equities, particularly in the US, where he believes retirement accounts like 401(k) plans are especially vulnerable.

Kiyosaki, a long-time critic of traditional financial systems, has consistently urged investors to diversify into alternative assets such as gold, silver, and Bitcoin.

Personal finance author and investor Robert Kiyosaki, who predicted the financial crisis of 2008-09, has once again sounded alarm bells over the stock market, cautioning of a possible major downturn. In a post on social media platform X, the Rich Dad Poor Dad author said that indicators are pointing to a “massive crash in stocks”.

“Stock market crash indicators warning of massive crash in stocks. Good news for gold, silver, and Bitcoin owners. Bad news for Baby Boomers with 401k. Take care,” Kiyosaki wrote in the post dated August 11, 2025.

Stock market crash indicators warning of massive crash in stocks.Good news for gold, silver, and Bitcoin owners.

Bad news for Baby Boomers with 401 k.

Take care.

— Robert Kiyosaki (@theRealKiyosaki) August 11, 2025

Kiyosaki, a long-time critic of traditional financial systems, has consistently urged investors to diversify into alternative assets such as gold, silver, and Bitcoin. He argues that these provide better hedges against economic uncertainty, inflation, and potential weakness in the US dollar.

The price of gold (99.9 purity) has jumped nearly 40% in the past one year and is now hovering around Rs 1 lakh per 10 grams. Silver is trading at around Rs 1,16,000 per kg, having climbed more than 44% in a year. Bitcoin has seen the biggest jump, surging more than 111% in a year and a price of $1,17,293 (as of August 17, 2025).

His latest warning comes at a time when global markets remain volatile, with concerns over high interest rates, slowing growth, and rising debt levels in the US. Kiyosaki has frequently predicted a sharp correction in equities, particularly in the US, where he believes retirement accounts like 401(k) plans are especially vulnerable.

In contrast, he maintains a bullish stance on precious metals and cryptocurrencies. In earlier posts, Kiyosaki has forecast that Bitcoin could eventually surge well beyond $100,000, while gold and silver prices could also see significant gains as investors flock to safe havens.

Kiyosaki earlier said that he began purchasing Bitcoin when it was priced at around $6,000 per coin and continued to buy as much as he could. Reflecting on that decision, he said, “I wish I had more fake money to buy more Bitcoin.”

The message reflects Kiyosaki’s long-standing skepticism toward fiat currency, which he often labels as “fake money”, and aligns with his consistent endorsement of hard assets like gold, silver, and crypto.

He also made a bold prediction: Bitcoin could reach $1 million per coin by 2030. While acknowledging that price does have importance, he stated that true wealth in the future will belong to those who control more units of valuable assets, not necessarily those who bought them at the lowest price.

While many market experts often push back on his extreme predictions, Kiyosaki’s warnings resonate with retail investors who see growing risks in conventional markets. His advice remains consistent: hold tangible assets and digital currencies as insurance against systemic shocks.

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h…Read More

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h… Read More

view comments

Read More