For the third quarter of fiscal 2026 (FY26), revenue from operations stood at ₹717.4 crore (~$78.04 million). For the nine months ended December 31, 2025, revenue from operations grew by 26.7 per cent year-on-year (YoY) to ₹2,987.2 crore (~$325.6 million), compared to ₹2,357.5 crore (~$257.0 million) in the corresponding period last year, driven primarily by the textile and related products segment and the consumer durables segment. The institutional business serving B2B and public sector clients contribute meaningfully to the growth.

Mafatlal Industries has reported ₹3,009.9 crore (~$331.1 million) revenue for 9 months, up 26.7 per cent YoY, driven by textiles and consumer durables.

Q3 revenue was ₹717.4 crore (~$78 million), affected by deferred orders during election periods.

EBIT margins improved to 6.4 per cent in textiles.

The order book stands at ₹1,200 crore (~$130.8 million), with gross debt at ₹52.8 crore (~$5.76 million).

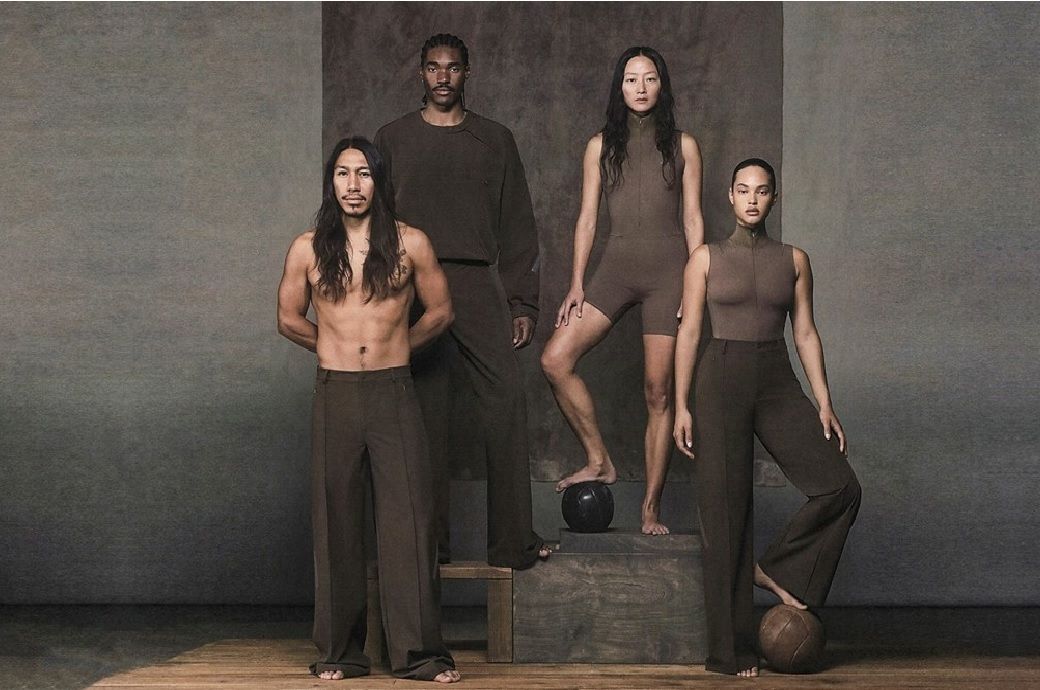

Revenues from the textile and related products segment grew by 15.7 per cent YoY, with EBIT margins improving to 6.4 per cent compared to 5.5 per cent in the first 9 months FY25. Margin improvement was supported by the company’s continued focus on expanding the uniform solutions umbrella.

In the digital infrastructure segment, the company executed ICT Lab projects across 333 public sector schools, including annual maintenance contracts, supporting stable segment performance, the company said in a press release.

The YoY moderation in quarterly revenue was due to deferred order execution during the election code of conduct period in the states of Maharashtra and Bihar and is expected to normalise from Q4 FY26.

Operating EBITDA margins remained stable, reflecting the resilience of the company’s asset-light business model.

During Q3 FY26, following the Ministry of Labour and Employment’s notification on the New Labour Codes, the company reassessed employee benefit obligations and recognised an estimated incremental liability of ₹2.87 crore (~$312,830) as an exceptional item.

As of December 31, 2025, the company’s order book stood at approximately ₹1,200 crore (~$130.8 million), providing strong revenue visibility for the coming quarters. Gross debt stood at ₹52.8 crore (~$5.76 million), compared to ₹68.3 crore (~$7.45 million) as of March 31, 2025.

“We are pleased to report a satisfactory quarterly performance despite temporary delays in revenue recognition due to the election code of conduct in Maharashtra and Bihar. Despite these temporary delays, our margins grew, reflecting our focused strategy and asset-light business model. Our nine-month results surpassed last year’s performance, driven by strong growth in the textile and consumer durables segments. With a robust order book of around ₹1,200 crore (~$130.8 million), we are well-positioned for the upcoming quarters and remain committed to strengthening our uniform business, exploring value-added opportunities, and delivering sustainable results,” MB Raghunath, chief executive officer, said.

Fibre2Fashion News Desk (RR)