Last Updated:

Online investment frauds, fake trading platforms, impersonation calls, KYC update messages, OTP theft and UPI-based scams dominate the complaint pipeline.

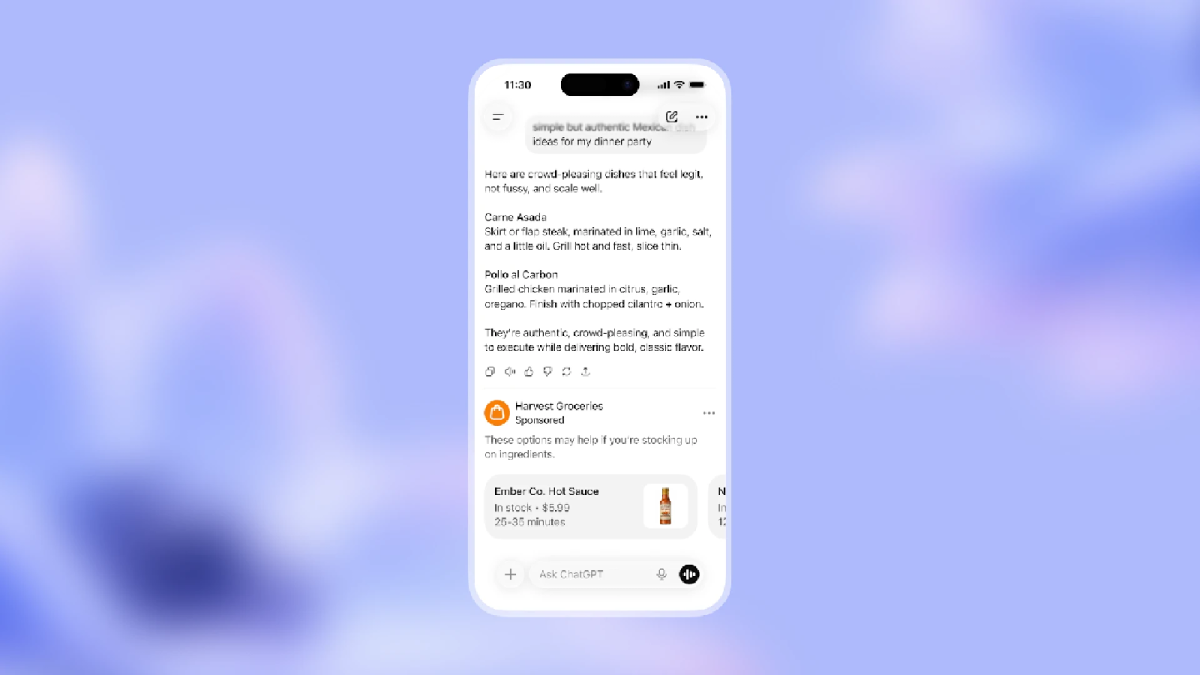

The most alarming aspect of the data is not just how much money is being lost, but how little of it is coming back. (Image: Canva)

Bengaluru’s status as India’s technology capital has long been a point of pride, but recent cybercrime data reveals a parallel reality that is far less reassuring. Over the last 45 months, the city has witnessed a surge in cyber fraud cases that has drained Rs 4,341 crore from residents, exposing serious gaps in digital awareness, enforcement capacity and recovery mechanisms.

Between 2022 and early 2025, a total of 53,252 cybercrime cases were officially registered in the city. Police officials caution that this figure likely underrepresents the real scale of cyber fraud, as many victims either report too late or avoid reporting altogether due to embarrassment or the belief that recovery is unlikely.

Complaints Rising Faster Than Enforcement Capacity

Bengaluru currently has 8 dedicated cybercrime police stations, which together receive more than 10 new complaints every day. Investigators say the nature of scams has become increasingly sophisticated, making detection and response more complex.

Online investment frauds, fake trading platforms, impersonation calls, KYC update messages, OTP theft and UPI-based scams dominate the complaint pipeline. In many cases, victims are lured with carefully crafted promises of high returns or threatened with account suspension, pushing them into hurried decisions.

While public advisories are regularly issued, the diversity and speed of these frauds continue to overwhelm both victims and investigative teams.

Losses Are Growing, Recoveries Are Not

The most alarming aspect of the data is not just how much money is being lost, but how little of it is coming back. Out of the total Rs 4,341 crore reported lost during the 45-month period, police have managed to recover only Rs 360 crore. Of this, Rs 334 crore has actually been returned to complainants.

In effect, less than 10 percent of the money stolen has found its way back to victims. Even when funds are traced and temporarily frozen, they are often routed through multiple accounts and withdrawn rapidly, reducing the chances of full recovery.

What the Year-on-Year Data Shows

A closer look at year-wise figures reveals how sharply cyber fraud has intensified in Bengaluru.

In 2022, the city registered 9,902 cybercrime cases, with reported losses amounting to Rs 281 crore. The following year saw complaints surge to 17,797 cases, while losses more than doubled to Rs 680 crore.

The most dramatic shift occurred in 2024. Despite a similar number of cases at 17,692, losses skyrocketed to Rs 1,995 crore. This suggests that fraudsters were extracting significantly higher amounts per victim, pointing to more targeted and financially devastating scams.

Even in 2025, with the year still underway, Bengaluru has already recorded 7,961 cases accounting for Rs 1,385 crore in losses, raising concerns that the final tally could rival or exceed previous years if trends persist.

Year-wise Cyber Fraud Data in Bengaluru (45 months)

| Year | Cybercrime Cases | Amount Lost (Rs crore) | Amount Frozen (Rs crore) | Amount Recovered (Rs crore) | Amount Returned to Victims (Rs crore) |

| 2022 | 9,902 | 281 | 100 | 51 | 51 |

| 2023 | 17,797 | 680 | 321 | 90 | 88 |

| 2024 | 17,692 | 1,995 | 917 | 170 | 156 |

| 2025 | 7,961 | 1,385 | 146 | 49 | 39 |

| Total | 53,252 | 4,341 | 1,484 | 360 | 334 |

Why Cybercriminals Remain Hard to Trace

Police officials say several factors complicate cybercrime investigations. Many fraud networks operate from outside the country, using foreign servers and masked IP addresses. Bank accounts are frequently opened using stolen or misused identity documents, while the money itself is split and moved across multiple layers within minutes.

By the time a complaint is formally registered and verified, the transactional trail has often gone cold.

Awareness Remains the First Line of Defence

Given these challenges, enforcement agencies stress that public awareness remains the most effective safeguard. Citizens are repeatedly advised not to click on unknown links, not to trust messages promising unusually high profits and never to share OTP or KYC details over calls or messages.

For a city driven by digital systems and convenience, the cybercrime figures serve as a sobering reminder. Technology may enable growth, but without caution and awareness, it also creates new vulnerabilities—ones that can empty bank accounts faster than the system can respond.

The News Desk is a team of passionate editors and writers who break and analyse the most important events unfolding in India and abroad. From live updates to exclusive reports to in-depth explainers, the Desk d…Read More

The News Desk is a team of passionate editors and writers who break and analyse the most important events unfolding in India and abroad. From live updates to exclusive reports to in-depth explainers, the Desk d… Read More

December 01, 2025, 11:26 IST

Stay Ahead, Read Faster

Scan the QR code to download the News18 app and enjoy a seamless news experience anytime, anywhere.