Last Updated:

Though Inflation is stable, the US economy is showing signs of stress. By cutting rates, Fed hopes to prevent a deeper slowdown or even a recession while keeping inflation in check

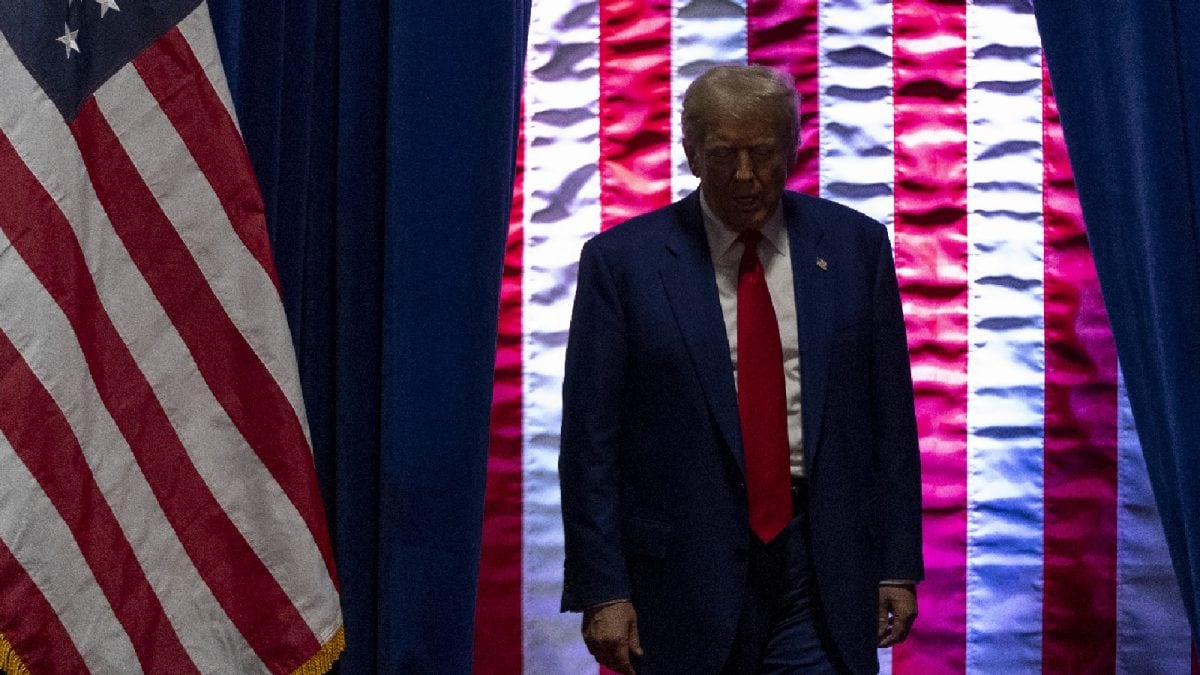

US President Donald Trump has been vocal in demanding lower interest rates. He has repeatedly argued that cheaper borrowing would accelerate growth and help American workers. (Photo: AP)

The United States Federal Reserve, the most influential central bank in the world, has taken a dramatic turn in its monetary policy. For the first time in over a year, it has reduced its benchmark interest rate, cutting it by 50 basis points to a range of 4.00-4.25%. While the move was widely anticipated, the timing and scale of the cut have sparked intense debate.

The decision comes after months of signals that the US economy was cooling down, inflation was stabilising, and unemployment was beginning to tick up. But the implications of this move are far greater than the borders of the United States—it is already reshaping financial markets globally, including in India.

Why Is The Fed Cutting Rates Now?

For the past two years, the US central bank’s top priority has been inflation. Following the pandemic, supply chains collapsed, energy prices surged, and households flooded the economy with pent-up spending. By mid-2022, inflation in America had climbed to four-decade highs, forcing the Fed to raise interest rates at a pace not seen since the 1980s. Borrowing became expensive, mortgages doubled, and businesses slowed their investments.

The strategy worked—at least partly. Inflation cooled from above 9% to closer to 3%. But the medicine also produced side effects. Growth began to weaken, corporate hiring slowed, and unemployment inched higher. Manufacturing output stalled, while consumer demand, once red-hot, showed signs of fatigue.

This is the environment in which the Fed has decided to cut rates. The reasoning is simple: inflation is no longer running wild, but the economy is showing signs of stress. By cutting rates, the Fed hopes to prevent a deeper slowdown or even a recession while keeping inflation in check. It is a delicate balancing act—too many cuts could reignite inflation, too few could choke growth.

Understanding The Politics Behind The Move

This is not just a story of economics; politics is playing a bigger role than usual. US President Donald Trump has been unusually vocal in demanding lower interest rates. Throughout his presidency, he has repeatedly argued that cheaper borrowing would turbocharge growth and help American workers. Critics, however, worry that his pressure is eroding the Fed’s independence, which has traditionally been shielded from political influence.

Several Trump-appointed members sit on the Fed’s policy-making committee, and their support for the cut has raised eyebrows. While the Fed insists its decisions are driven purely by economic data, the timing—just as the economy shows early signs of weakness—has added fuel to the debate. For markets, the question is not whether the Fed is independent, but whether Trump’s influence could push the central bank towards more aggressive cuts in the future.

What It Means For The US Economy

For American households, the immediate impact of a rate cut is modest but real. Mortgage rates may come down slightly, making home loans more affordable. Car buyers and small businesses that depend on loans could also find relief. Credit card debt, one of the biggest burdens for households, might see some easing.

For companies, lower borrowing costs could encourage fresh investment, particularly in sectors that had put expansion plans on hold. The hope is that this will revive growth without letting prices spiral again.

But the risks are equally clear. If inflation rises again, the Fed could be forced to reverse course, raising rates once more. That yo-yo effect—cutting now, hiking later—would create more uncertainty for businesses and households alike.

What Does The Rate Cut Mean For India?

India, like other emerging markets, is closely tied to US monetary policy. Whenever the Fed cuts rates, the global financial system adjusts. Lower returns in the US often push investors to seek higher yields elsewhere, and India is one of the biggest beneficiaries.

Foreign portfolio investors tend to increase exposure to Indian equities and bonds when US rates fall. This could mean stronger inflows into Dalal Street, more demand for the rupee, and a potential rally in Indian stocks. For the Reserve Bank of India, which has been carefully managing the rupee to prevent excessive volatility, such inflows are both an opportunity and a challenge.

Indian companies that have borrowed in dollars could also benefit. Lower US interest rates make it cheaper to refinance debt, reducing pressure on corporate balance sheets. This is especially important for infrastructure and energy companies with large overseas borrowings.

But there are risks too. A weaker dollar can drive up global commodity prices, including crude oil. Since India imports more than 80% of its oil needs, higher prices would hit both inflation and the trade deficit. In other words, while Indian markets may cheer the Fed’s cut, Indian households could feel the pinch at the petrol pump if oil prices climb.

What Is The RBI’s Dilemma?

The RBI now faces a policy conundrum. Should it follow the Fed’s lead and cut rates to maintain competitiveness, or hold firm to keep inflation under control?

India’s growth has been robust compared to many major economies, with strong services exports, rising consumption, and government spending driving momentum. But inflation, particularly food prices, remains a persistent worry. A premature rate cut could reignite inflationary pressures, eroding household savings and hurting the poor the most.

For now, the RBI is likely to adopt a wait-and-watch approach. It may allow the Fed’s move to play out in global markets before deciding on its next step. If capital inflows strengthen the rupee and inflation remains contained, a rate cut later in the year could be on the table. But unlike the Fed, the RBI does not have to worry about political pressure to act quickly.

How Does It Impact Global Economies?

The Fed’s move is also reshaping the broader global economy. In Europe, where growth is anaemic and inflation is easing, central banks may feel more comfortable cutting rates in tandem. In Asia, particularly in export-driven economies like South Korea and Taiwan, the impact on currencies and trade flows will be closely watched.

For developing nations, the rate cut is a double-edged sword. On one hand, easier global liquidity can attract more investment. On the other, a weaker dollar could fuel volatility in commodity markets, creating challenges for countries dependent on imports.

What Happens Next?

The big question is whether this cut is a one-off or the beginning of a cycle. If unemployment continues to rise in the US and growth stalls further, the Fed may be compelled to deliver more cuts. That would be welcomed by global markets but could complicate the fight against inflation.

If, however, inflation flares up again—perhaps due to higher energy prices or supply disruptions—the Fed may hit pause. This uncertainty means investors, businesses, and governments around the world must prepare for volatility.

What Should Indians Know

There are three takeaways for Indians in this. First, the Fed rate cut could bring more foreign investment in the Indian markets, boosting stocks and strengthening the rupee. Second, there is a real risk of higher oil prices, which would directly affect household budgets. Third, the RBI is unlikely to move in lockstep with the Fed, instead choosing a path that balances growth and inflation.

In the short term, markets may cheer the Fed’s decision. But in the long term, much depends on whether the US economy stabilises or stumbles. If the US economy slows sharply, India will feel the ripple effects through weaker exports and global demand.

What To Conclude?

The Fed’s rate cut is more than just a technical adjustment in Washington—it is a signal with global consequences. For India, it brings both opportunities and risks. Stock markets and companies with overseas debt may gain, but households could face pressure if oil and food prices rise. The Reserve Bank of India’s cautious stance will be crucial in navigating this shifting global landscape.

In today’s interconnected world, a rate decision in the US can affect many economies in the world. Thus, the Fed’s latest move matters not just for Wall Street, but for an Indian investor, consumer, and policy-maker.

Shilpy Bisht, Deputy News Editor at News18, writes and edits national, world and business stories. She started off as a print journalist, and then transitioned to online, in her 12 years of experience. Her prev…Read More

Shilpy Bisht, Deputy News Editor at News18, writes and edits national, world and business stories. She started off as a print journalist, and then transitioned to online, in her 12 years of experience. Her prev… Read More

September 18, 2025, 14:04 IST

Scan the QR code to download the News18 app and enjoy a seamless news experience anytime, anywhere