Last Updated:

Chartered accountant Ravi Ranjan from Ranchi, in a chat with Local18, stressed the need to avoid mistakes while filing ITR, as even minor errors can lead to heavy fines and jail

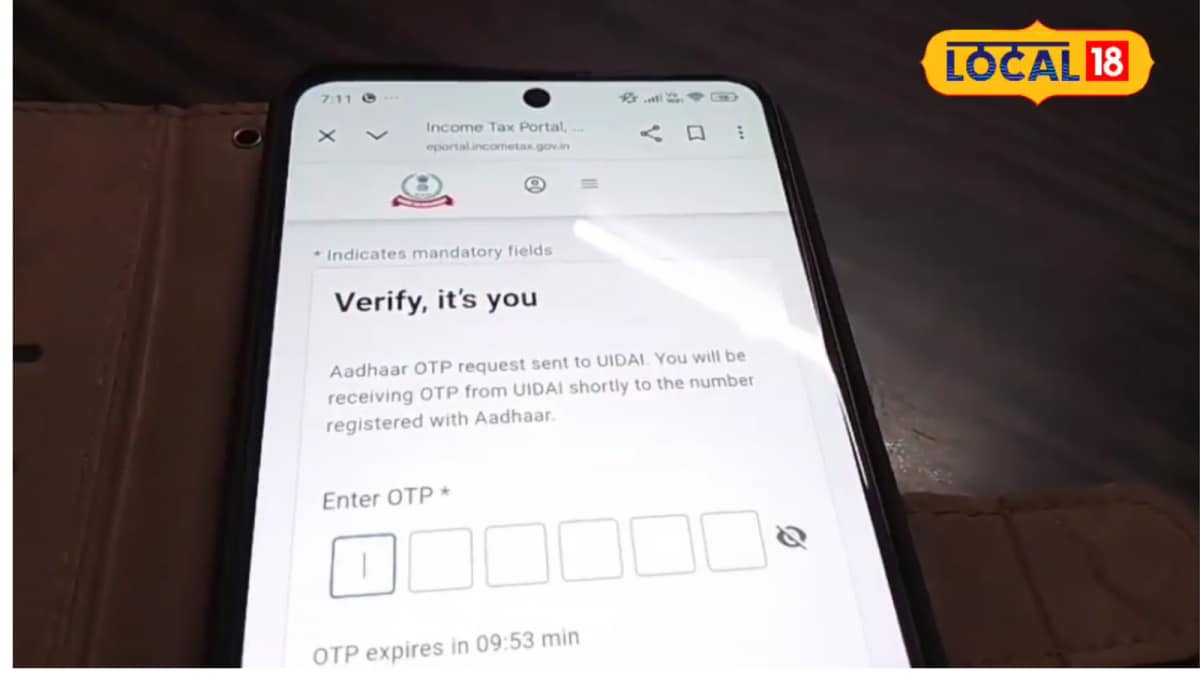

E-verifying the ITR within 30 days of filing is mandatory. (Local18)

The deadline for filing Income Tax Returns (ITR) is fast approaching. Failure to disclose or omit small pieces of information while filing ITR can result in a fine of up to Rs 10 lakh and imprisonment for 6 to 7 years.

Chartered accountant Ravi Ranjan from Ranchi emphasised the importance of avoiding these mistakes in a conversation with Local18. Here are the key points to remember:

Provide Complete Details Of Any Property Owned Abroad

Individuals residing in India who own property abroad must fill out Schedule FA, providing details of their overseas bank accounts, shares, insurance, property, and other assets. Incomplete information could lead to a fine of up to Rs 10 lakh and imprisonment for 6 months to 7 years. Similarly, any income derived from foreign sources must be detailed in Schedule FSI, specifying the country of origin and the tax paid. Non-disclosure may also result in a fine of up to Rs 10 lakh.

Full Details Of Transactions Required

Full transaction details are essential for those dealing in cryptocurrency or NFTs. Information must be provided in Schedule VDA, indicating the purchase and sale dates, and the amounts involved. Additionally, if one holds shares in an unlisted company, they must report the acquisition and sale details, including the number of shares involved.

If Total Income Exceeds Rs 1 Crore

For individuals with a total income exceeding Rs 1 crore, it’s necessary to disclose assets and liabilities, including property, jewellery, vehicles, shares, cash, loans taken, and loans given. Company directors must provide their Director Identification Number (DIN), the company’s name, PAN number, and whether the company is listed.

Verification Is Mandatory

If one is a partner in a firm, details such as the firm’s name, PAN number, status, share, and any salary or interest received must be provided. It is also crucial to verify bank account details to ensure correct IFSC codes and account types for refunds. E-verifying the ITR within 30 days of filing is mandatory; otherwise, the ITR will not be valid.

September 15, 2025, 12:06 IST

Read More